Eton Properties Goes Green

May 12, 2017

North Belton Communities: Affordable city living at its best

July 21, 2017Eton Properties sets P5-B capex for expansion

&nsbsp;

Eton Properties Philippines, Inc., the real estate arm of the Lucio Tan group, is allotting P5 billion for capital expenditures (capex) this year to allow it to expand its recurring income stream.

"On the back of a favorable 2016 performance, we look forward to continuing our growth story by further expanding our footprint in the office, commercial, and residential leasing markets, by opening new projects in other prime locations," said Eton President Lucio Tan Jr.

The expansion includes developing Eton's hospitality business by converting a portion of its Eton Makati residential project into a suite-type lodging under the brand of sister-company Eton Hotel Hong Kong.

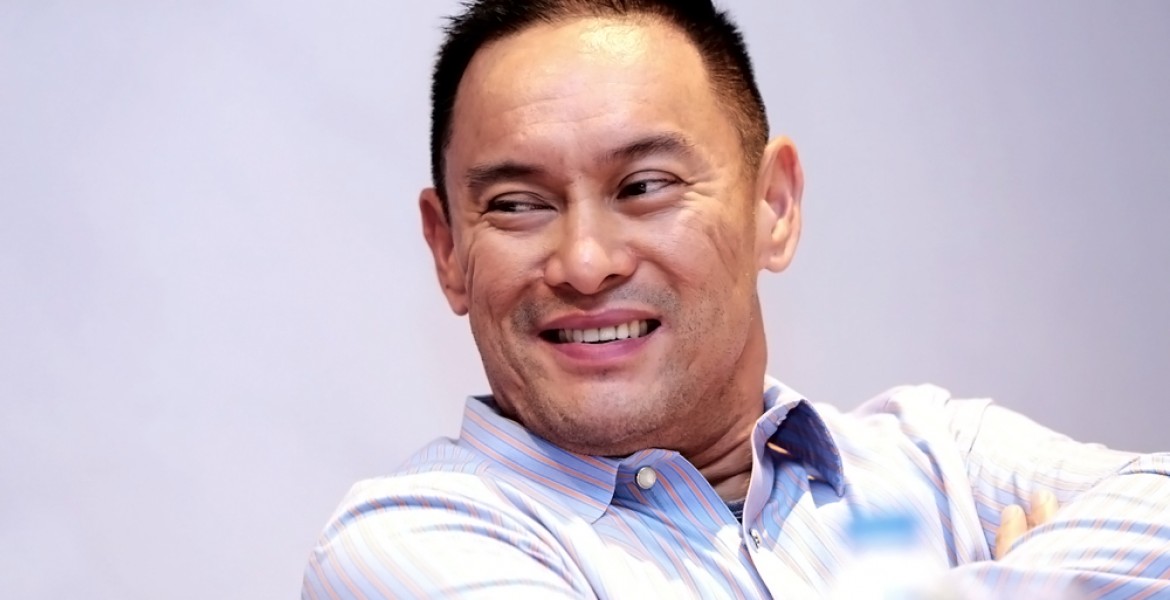

Eton Deputy chief operating officer Jess Lucas said they will be converting 360 units of the more than a thousand unit in Eton Makati and rebrand these as Eton Hotel mini-suites, an adoption of the Hong Kong company's products.

The new product was officially launched in December last year with the company expecting a gestation period of "six months to one year" to determines its viability to be duplicated in other Eton areas in the country.

Lucas said Eton mini-suite is positioned to the "free independent travellers" in Makati, focusing on foreign visitors as well as people doing business in Makati.

Other than the hotel business, Eton using the P5-billion capex to build an additional business process outsourcing office space amounting to 16,000-square meters (sqm); a 6,000-sqm two-tower, mixed-use development in Manila, along Roxas Boulevard, beside Admiral Hotel; a 33,000-sqm commercial hub in Eton City, and a 1,500-sqm., commercial strip along Ortigas Ave., in Greenhills.

The P5-billion capex will be funded by a number of credit facility the company signed, particularly from sistercompany Philippine National Bank, said Eton Chief Finance Officer Wilfredo Pineda.

Pineda said the credit facility will cover 70 percent of the capex while the balance with be funded by internally-enerated cash. Pineda said Eton looks to put up 170,000 sqm. of additional leasable space in the next three years to complement the existing 147,000 sqm from the company's BPO and commercial spaces, to bring the company's portfolio to more than 300,000 sqm.

Lucas said the increase in leasable space will allow the company to raise the share of recurring income to 60 percent of revenues for the medium term from the current 45 percent. This year, Eton expects to see its recurring income hit 50 percent of the total pie.

Latest News:

December 10, 2025

November 16, 2025

October 24, 2025

October 15, 2025